Is repairing a rack a capital expense or just an operating cost?

Capital vs. operating expenses can be confusing, especially when you’re under pressure to fix a damaged rack, justify a safety upgrade, or plan next year’s warehouse budget.

In this article, we’ll break down how to classify rack-related costs, maximize your ROI, and navigate the CapEx vs. OpEx conversation with your finance team. Whether you manage a single facility or a national network, this article will help you budget smarter, act faster, and stay compliant without compromising warehouse safety.

Quick Summary

- Capital Expenditures (CapEx): Large, one-time investments that improve or extend the life of your warehouse infrastructure. Think: installing new pallet rack systems or engineered repair kits.

- Operating Expenditures (OpEx): Recurring expenses required to keep the warehouse running safely day-to-day, like annual rack inspections or replacing damaged beams.

💡 Ask yourself: Does this expense increase the value, capacity, or lifespan of your racking system? If yes → CapEx. If not, and it maintains current functionality → OpEx.

Why Warehouse Managers Should Care About CapEx vs. OpEx

- Approval timelines: CapEx may require board approval; OpEx often does not.

- Tax strategy: OpEx is fully deductible in the same year. CapEx is depreciated over time.

- Operational agility: Using OpEx allows for a faster response to rack damage or safety issues.

⚠️ Important: CapEx and OpEx classifications vary by jurisdiction and accounting policy. Consult your financial advisor.

What Is CapEx in a Warehouse Setting?

Capital expenditures are purchases or upgrades that add value and provide benefits for more than 12 months. In warehousing, this includes:

| CapEx Item | Warehouse Example | Strategic Benefit |

|---|---|---|

| New equipment or assets | Installing a new selective racking system | Increases pallet capacity |

| Structural upgrades | Installing DAMO PRO or DAMO FLEX repair kits | Extends rack lifespan, restores original capacity |

| Tech-enabled improvements | Adding IoT rack sensors or seismic baseplates | Prevents future risk, enables remote monitoring |

Accounting treatment: CapEx is capitalized and depreciated over multiple years (IRS MACRS in the U.S., CRA CCA classes in Canada).

What Counts as OpEx for Rack Safety?

Operating expenditures are short-term costs tied to regular operations and safety maintenance. These include:

- Annual rack inspections performed by Damotech-certified engineers

- Subscription fees for the premium version of Damotech’s rack inspection and maintenance software

- Consumables and accessories, like column guards, anchor bolts, or beam connectors

- Emergency repairs for minor damage that don’t extend the rack’s lifespan

Why use OpEx? Quick fixes using OpEx help you react fast, especially when rack damage needs immediate attention to avoid shutdowns.

5-Step Decision Matrix: CapEx or OpEx?

1. Useful Life

Will the benefit last more than 12 months? → CapEx

2. Capacity Gain

Does it increase the functionality or storage of the system? → CapEx

3. Materiality

Is the cost above your company’s CapEx threshold (e.g., $5,000)? → CapEx

4. Is It a Repair or an Upgrade?

- Fixing a broken brace = OpEx

- Reinforcing with engineered protection = CapEx

5. Standalone or Project?

Bundling small repairs into a larger modernization plan may qualify as CapEx

Illustrative Example: Rack Repair ROI Scenario

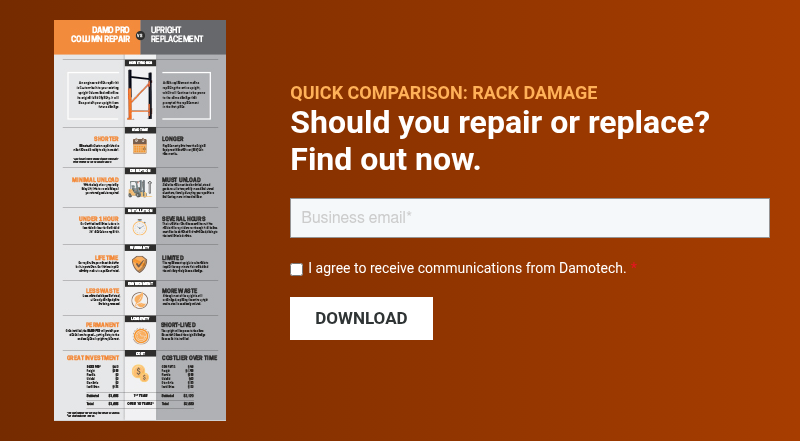

Scenario: A typical 3PL facility operating in a high-traffic warehouse environment experiences 12 damaged rack uprights per year due to forklift impacts and operational wear.

| Option | Action | Cost | Outcome |

|---|---|---|---|

| OpEx | Replacing each upright with OEM parts as damage occurs | $25,560/year | No long-term savings; the same issue recurs |

| CapEx | Install 12 DAMO PRO repair kits with a lifetime warranty | $12,780 one-time | No recurring cost; break-even in 6 months and saves ~$240,000 over 10 years |

📊 ROI Analysis: The CapEx route pays off in under 6 months and improves long-term safety and compliance.

Tax Implications: U.S. vs. Canada

| Country | Accelerated Tax Benefits |

|---|---|

| U.S. | Section 179 deduction (up to $1.25M in 2025); 40% bonus depreciation |

| Canada | Accelerated Investment Incentive: Provides up to one-and-a-half times the normal first-year Capital Cost Allowance on eligible capital items |

💡 Tip: Consult with a CPA to explore how to maximize these incentives when upgrading or reinforcing your racking system.

Warehouse Budgeting Best Practices

- Use a Hybrid Strategy: Fund inspections and minor fixes through OpEx; use CapEx for long-term solutions like engineered repairs.

- Plan CapEx Ahead: Add known damage sites to your next-year CapEx request now to avoid delays.

- Tie Repairs to GL Codes: Export damage reports directly from Damotech’s rack inspection app and match them with general ledger (GL) codes in your finance system.

- Collaborate Cross-Functionally: Align finance, ops, and safety teams in quarterly meetings to review rack-related costs.

- Leverage Dealer Networks: Damotech’s network of over 200 North American dealers can stock and stage repair kits at your site, improving deployment speed and budgeting accuracy.

What About Consulting Services: CapEx, OpEx, or Both?

Hiring rack safety experts or consultants for strategic safety planning may fall under either CapEx or OpEx, or a hybrid of both.

If the service results in long-term value, such as a multi-year rack safety program, intellectual property, or engineering documentation that shapes future investment, it may be classified as CapEx.

On the other hand, ongoing advisory support or audits addressing current operational issues are typically treated as OpEx.

To plan effectively, assess which safety initiatives support long-term infrastructure improvements (CapEx) and which fall under routine maintenance or compliance (OpEx). Planning ahead allows you to align your budgeting strategy and gain faster approval for safety-critical initiatives.

Key Takeaways for Warehouse Professionals

- CapEx adds long-term value: Think new rack installs or engineered reinforcement.

- OpEx handles day-to-day risk: Use it for inspections, emergency fixes, and consumables.

- Proactive planning saves money: Classifying repairs correctly can streamline budget approvals and reduce long-term costs.

- Leverage Damotech: From flexible repair kits to professional inspections and safety software, our solutions help you stay compliant, safe, and budget-aligned.

Frequently Asked Questions

Can I expense a rack repair kit as OpEx if it costs under $5,000?

It depends on your internal accounting policies. Many companies have a materiality threshold for CapEx. However, if the kit significantly extends rack life, auditors may classify it as CapEx regardless of cost.

Do safety inspections qualify as CapEx?

Typically, no—unless they’re part of a larger capital project (like post-install certification for a new AS/RS). Routine inspections are OpEx.

What’s the best way to get CapEx projects approved?

Bundle safety-related repairs into a larger modernization project with a clear ROI. Quantify downtime risks, safety exposure, and total cost of ownership to make a compelling case to finance teams.

Ready to Plan Your Budget Smarter?

📞 Book a free consultation with a Damotech rack safety expert.

Disclaimer: This article is intended for informational purposes only and does not constitute financial or tax advice. Please consult your accounting advisor to determine the correct classification of expenses in your jurisdiction.